Top 10 Forex Strategies for Profitable Trading in 2021

The estimated trading volume of the foreign exchange (Forex) market stands at $6.6 trillion, a figure that exceeds even the volume traded across all stock markets. That is one of the primary reasons why the profit-seekers are flocking to Forex day after day. But the statistics have it that the overwhelming majority of traders are losing money. Obviously, that happens due to the lack of time-tested Forex trading strategy and money management skills. The year 2020 has proven to be tough on Forex and all other financial markets, but it has also given an opportunity to revise many trading systems and approaches and come up with a list of the best Forex strategies for 2021 that have proven their efficiency even at such turbulent times.

VWAP — a solid foundation for an intraday trading strategy

VWAP stands for the volume-weighted average price — it’s an indicator that we deem to be superior to many other charting tools because it takes into account both the trading volume and the price of a currency. It is calculated by multiplying the sum of price by trading volume and then dividing that number by total volume. The inclusion of volume in calculations is the trait that makes VWAP a very powerful indicator — and in our opinion, often underused — alternative to the 9-day and 25-day moving averages since VWAP is considerably slower, thus providing far less false Forex trading signals. The indicator’s other significant feature is that it’s often used as a guiding landmark for big market players like institutions and pension funds, whereas retail traders often disregard VWAP when devising the intraday Forex trading strategy while focusing on popular indicators that often lead them astray. 15M EUR/USD chart The rule of thumb for using VWAP is rather simple: a trader must give preference to long trades when the price action occurs above the indicator and consider taking short trades when the price dives below the line. But remember that it should be included in the currency trading strategy only for a single day of trading as it reboots every day prior to the market open, so avoid building the mid-term, and especially long-term trading strategies on Forex, on the basis of VWAP showings. However, VWAP works best when used in combination with the actual volume indicator, the 9-period moving average, and a momentum oscillator like MACD since they provide sufficient confirmation for entering a trade. The EUR/USD chart above provides an example of how the Forex strategy that incorporates VWAP can be applied. Here we see the price dropping below 9MA and VWAP, signifying a strong selling pressure, which is confirmed by the bearish MACD and the mounting bearish volume. According to this trading strategy, you should make the first sell at 1.2175 and keep on selling if 9MA dives below VWAP, a move that is called the VWAP cross.

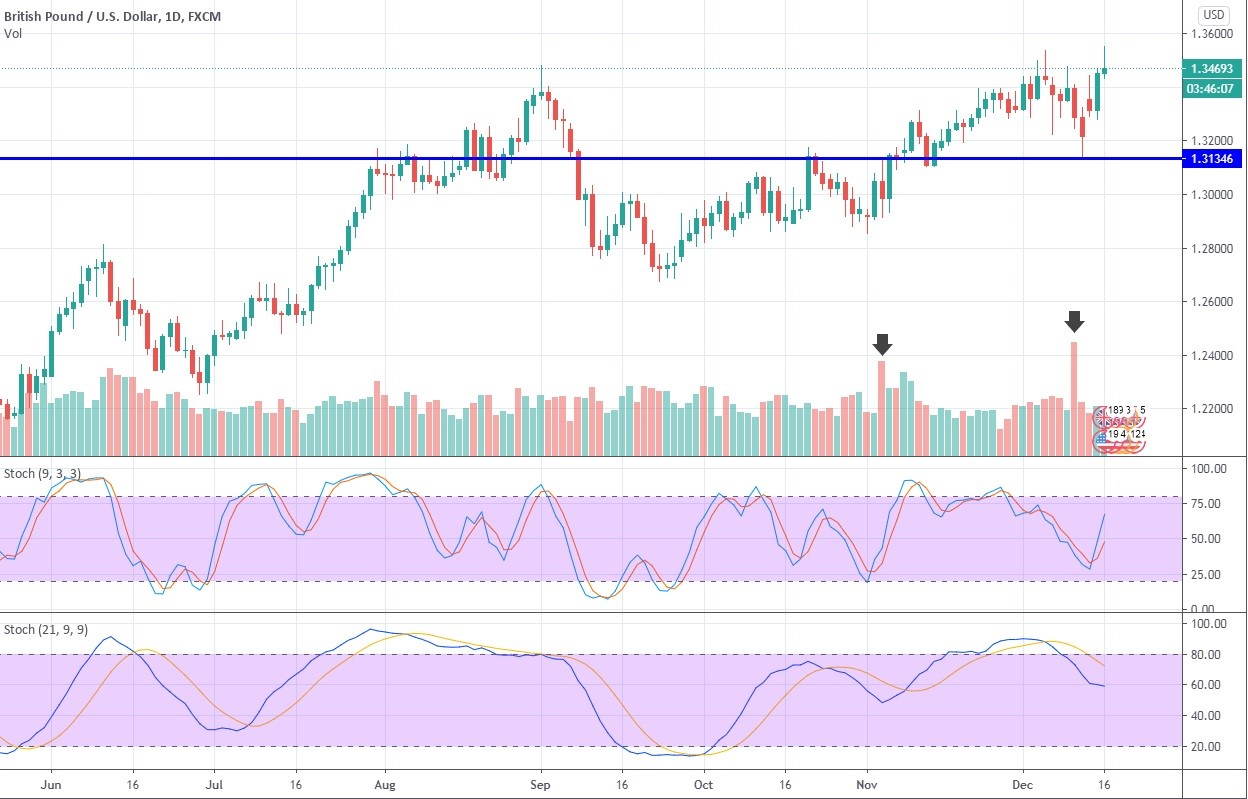

Support/Resistance and two Stochastics — a powerful combo for successful Forex trading

- Always consider the trading volume when plotting S/R lines. The price action zones on the charts that saw the largest volume spikes should always be taken into consideration as they indicate the areas of increased supply or demand;

- Remember that the horizontal support is considered more reliable than the diagonal one, especially when it comes to determining the pivot points.

- When determining S/R for your trading strategy, remember to start from the macro time frames (monthly, weekly) and gradually move down to the lower ones.

For this Forex trading strategy, we will employ horizontal support and resistance, combined with two Stochastics: the fast one, set at 9-3-3, and the slower version of the same indicator with the settings of 21-9-9. The idea behind this strategy is the following: determine a strong S/R level by analyzing the trading volume and then use the showings of Stochastics to determine the immediate and mid-term momentum and plan the trades accordingly. In this example, the fast Stochastic is bullish while the slow one is obviously bearish, so we might be looking at a spike to 1.369, followed by the pullback to 1.313. For this currency trading strategy, it’s immensely important to understand where the momentum is taking the price when it approaches the area of intense price interaction, as it hints at whether the S/R line would be able to hold.

Employing Parabolic SAR and MACD to maximize the profits

The Forex strategy that utilizes the Parabolic SAR and MACD is fairly simple and applicable to all timeframes higher than 15M, and to many currency markets. Besides, these two indicators are available on all Forex trading platforms for free, thus making it even more useful. It comes to show that your strategy doesn’t have to be overly complicated in order to be profitable. Oversaturating your strategy with complex trading tolls would oftentimes result in total discordance. At the same time, throwing SAR and MACD on top of candlesticks would keep the chart clean while providing enough signals for successful trading on Forex.

1D GBP/USD chart

Please keep in mind that the SAR/MACD Forex strategy works best only in trending markets, whereas its efficiency tends to decrease when the price gets into the range since SAR is the trending indicator.

In our experience, EUR/USD and GBP/USD are the most suitable markets for this strategy since they are more volatile than some low-volume exotic pairs. In this instance, the MACD settings should be 12- 26-9, while the Parabolic SAR must be set at 0,02 -2.

According to this strategy, a trader should go long when the dots of Parabolic SAR are located below the price action while the MACD is crossing the zero line to the upside while three SAR dots are forming. If the SAR dots have already appeared while MACD is still below the zero line, such a signal should be considered false. For short trades, the Parabolic must be above the forming candlesticks while MACD should be crossing the zero line to the downside.

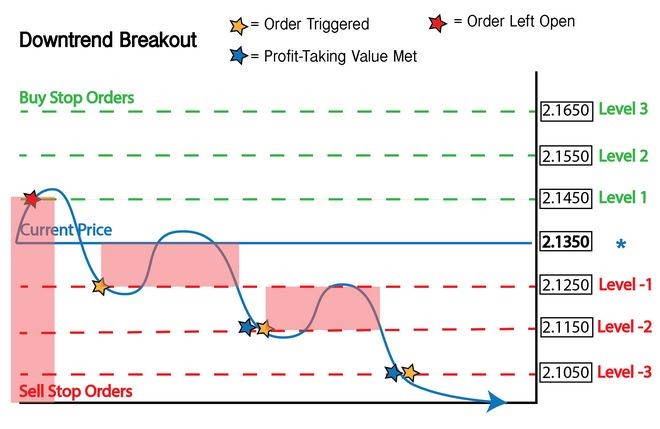

Grid trading on Forex

Arranging the buy/sell order in a grid with equal intervals has long been considered as one of the best Forex strategies, as well as a universal one since it can be applied to trading currencies on all timeframes and in both trending and ranging markets. The gist of this approach to trading is also rather simple. A trader has to place the corresponding orders above and below the predetermined price level at the same distance, ultimately creating a grid of orders, hence the name of the Forex trading strategy.

For instance, you can start the grid by placing the corresponding orders 20 pips higher for buy orders and 20 pips lower the set price for sell orders in the trending market conditions. This Forex strategy is also applicable to ranging markets, but in that case, a trader should set the buy orders underneath the price level — the buy order will go above the said zone.

The best thing about this method is that it rarely requires an extensive analysis of where a particular Forex market is going, making it one of the most automatable strategies of average complexity. Grid trading allows market participants to increase the position size while the market is either trending or ranging. But beware that this approach to Forex trading is most effective when the price is moving in a sustained direction. If the price action is volatile and choppy, it might travel up and down between the grid levels, while the trader incurs losses due to price hitting orders on both sides. That’s why it’s advisable to limit the grid to several orders; otherwise, it would require less position management and help mitigate the risks.

Monday open — trade Forex one day a week

Littering the trading panel with indicators might make a Forex trader look smart, but it would definitely do more harm than good for his performance since most of these tools are lagging and flashing false signals. However, there is a Forex strategy for positional trading that requires no indicators as it uses only a clear bar or candlestick chart. This method relieves traders of the necessity to stare at the screen throughout the weekdays as it implies the execution of one or a few trades a week on Monday, shortly after the market opens. Understandably, this strategy is suitable only for the daily time frame, and it probably works best in the EUR/USD market.

1D EUR/USD chart

The concept behind this strategy for trading on Forex isn’t that complicated: on Monday, approximately 15 minutes after the market gets busy (this time interval is required to normalize the spreads), a trader should open the position in the direction opposite to the candlestick from last Friday. For example, if a trader had taken a long position on Monday in the EUR/USD market (as shown on the chart above), he or she would have scooped a profit of 125 to 205 pips the next Monday. For this strategy, use the highs or the lows of the last week’s candle to set up the stop-loss, but make sure that it’s located no closer than 30 pips and no further than 50 pips away from the buy/sell area, depending on the present volatility in the market. Also, this currency trading strategy requires meticulous money management and position sizing. Refrain from entering a trade if the market is in a state of uncertainty, which could come in the form of a candle with a small body and large wicks.

The Forex strategy built upon momentum oscillators and Bollinger Bands

Volatility is one of the key characteristics of the foreign exchange market. It causes large price swings during which time a trader must seize an opportunity for profit-making when the price is pulling back or reversing after a strong impulse to the upside or the downside. Apart from the Average True Range (ATR) indicator, Bollinger Bands (BBs) are the most reliable tool for gauging market volatility. The basic principle of trading Forex with BBs is simple: the expansion of the bands signals that the price action in the particular currency pair is growing increasingly volatile, whereas the contraction of the bands occurs during the consolidation period when the price is in the range. There is also the Bollinger Bands squeeze, the period when the bands are drawn very close to each other that usually precedes large price swings.

1D GBP/USD chart

However, BBs are not a standalone element of this trading strategy for Forex because the only reversal signal it provides is when the price action stretches beyond the boundaries of a band. However, that particular signal always requires confirmation from a non-correlated Forex trading indicator — in our case, it’s the moving averages divergence/convergence (MACD) momentum oscillator. Here, when the MACD line crosses the signal line and/or the zero line to the downside, it’s considered a sell signal, and vice versa. The idea behind this Forex strategy is the following: a trader must assess the situation on the market with the help of MACD or other momentum indicators (RSI, Stochastic) to see whether there’s a bullish or a bearish bias to it. Then he could trade the price action within BBs or wait for a squeeze and take the trade in the direction of the momentum. This strategy can also be used for trading reversals. In that case, the perfect setup for a trade is when the price penetrates the BBs while the momentum oscillator makes a bullish of a bearish crossover.

The daily GBP/USD chart provides a perfect example of how this Forex strategy can be applied. Here we see that the price is heading to the upside, stretching the BBs, which implies the increased volatility in buyers’ favor. MACD has just made a bullish crossover on the back of a growing green histogram. Moreover, the price had broken the resistance line at 1.3485 to the upside, which gives even more puff to the bullish momentum. Here one can enter a long trade immediately or upon the retest of the resistance line, with the stop-loss set around 1.34. Exit the trade when the price starts being pulled back inside the bands, confirmed by the bearish crossover on MACD.

Who to trade Forex successfully with Ichimoku Cloud

For some reason, not a lot of Forex traders are using the Ichimoku Cloud, or the Ichimoku Kinko Hyo,an indicator to develop trading strategies, probably because this tool is relatively new to mainstream and appears to be overly complicated at first. It might look like a total mess when you first plot it on the chart, but we reckon that it’s probably the only all-around useful technical indicator that allows traders to assess the momentum and the area of support/resistance at a glance. By the way, the Japanese word ‘ichimoku” literally means “a single glance.” This indicator consists of five elements, but it can do without the conversion and base lines, leaving only a lagging span, which provides confirmation, and two leading MAs that form that cloud.

15M EUR/USD chart

What’s great about the Ichimoku Cloud-based Forex trading strategy is that this indicator pinpoints the high probability trades, and has proven to be reliable when determining trend reversal and entry/exit points. The market is considered to be in the bullish trend when the price action takes place above the Kumo cloud and bearish if the price descends below it. If the price is stuck inside the cloud, the market is indecisive, so refrain from taking any trades. The reason why no trades should be taken when inside the cloud is that this indicator is most accurate in a trending environment. Here’s a quick Forex strategy tip: in order to have an even clearer picture, it’s advisable to combine Ichimoku Cloud with a momentum oscillator like MACD.

Since this trading system is suitable for all time frames higher than 15M, let’s break it up on the 15-minute chart in the EUR/USD market. According to this strategy, a trader must make the first long entry once the price breaks the Kumo cloud to the upside and tests this level — 1.21982 in our instance. The second entry should be on the retest of that area at 1.21942.

In this particular example, the third entry was made after the bullish flag (continuation pattern) has been broken to the upside at 1.22096. Notice that all these entries were made after MACD entered the bullish control zone on the backdrop of a growing green histogram. Also, don’t forget to always confirm with the lagging span that accurately gauges the trend direction. According to this Forex strategy, the first exit point lies at 1.22364 (40 points profit); the second one should be at 1.22580 for a 61-pip profit.

New tricks for an old breakout trading strategy

Trading a breakout is as old as the hills, but it still remains one of the best Forex trading strategies for 2021. In a nutshell, trading on a breakout implies placing a long or short order when the price of a currency moves above (below) the support (resistance) level, and outside the previously established range on the back of the rising bullish (bearish) volume. But while the essence of this Forex strategy isn’t too complicated, its execution requires a lot of skill because of a large number of fake-outs that is characteristic of most Forex markets. So, the gist of this strategy is to minimize the time when a trader gets caught in a fake-out and avoid being stopped-out before the market starts going the right way.

For the breakout strategy to work and result in profitable trading on Forex, you need to have these attributes present in order to consider taking a long or a short trade.

Let’s assume we have a break of a trendline with a hint at a trend reversal or a breach of a long-standing resistance with multiple test points, or a fall through the long-term support level on an increasing bearish momentum that is very common in Forex at times when markets are entering new territories, and the re-pricing occurs.

The first thing that a trader needs to see before considering a trade is a surging volume on the breakout. And even though it’s a rule of thumb for this particular trading strategy, many Forex traders tend to disregard it, being blinded by the desire for the breakout to happen. But in addition to growing volume, there also has to be an extension of the day’s range, which implies the participation of other traders in that move.

Always look for fundamental catalysts that can potentially impact the valuation of a certain nation’s currency, such as a sudden cut of interest rates or the release of important economic data. The presence of a catalyst drives new money to the particular Forex market and adds significant weight to the move, thus increasing the chances of a successful breakout.

Pay attention to the speed at which the price retests the previous support or resistance — it should happen quickly; otherwise, the move is most probably a fake-out. This rule is especially relevant for a more dynamic intraday Forex trading. A quick retest signifies that the momentum is on the trader’s side and that the move carried a lot of weight. And never forget to confirm the move on higher timeframes.

Playing the exhaustion gap trading strategy

In Forex markets, the gaps occur during the large jumps in currency prices that often signifies that little to no trading took place in that area. Oftentimes, the gaps occur at the market open or under the impact of various technical or fundamental factors. A quick reminder that there are four types of gaps: breakaway, exhaustion, continuation, and common gaps. Please remember about the importance of proper gap identification because each type requires a specific Forex trading strategy to be applied. This particular strategy is suited for trading exhaustion gaps on the short side.

4H EUR/USD chart

Here we see the 4H EUR/USD chart where the price gapped up by 40 pips after having tested the resistance at 1.13572, thus turning this area into support. It is of the utmost importance to confirm that the gap is of the exhaustion kind, which in our case is done via a huge bearish divergence on Stochastic and the presence of a protracted bullish move with the predominance of shallow retracements.

According to this foreign currency trading strategy, a trader can either try and catch the top of the move and then open a short position, which is a very aggressive approach, or he can wait until the gap gets filled and the price tests the previous support and fails (less profitable but with the higher probability of success). The first take-profit area lies in the zone of bullish accumulation that occurred during the rally. In our case, it’s 1.11. The second profit taking is made when there are clear signs of a trend reversal. Here it’s the established support above 1.06 and the exit of Stochastic from the oversold area.

Jesse Livermore’s wisdom to enhance every Forex trading strategy

As you may know, Jesse Livermore is an icon trader who earned his reputation by making $100 million in a single day in the 1920s. His biography called “Reminiscences of a Stock Trader” is a bedside book of every successful Forex trader, and the market wisdom that this prominent trader had given us, modern-day traders, should be applied to literally every Forex trading strategy that you plan on using in 2021.

- According to Livermore, patience is key to profitable trading, whether it’s Forex, stocks, or cryptocurrencies. Traders must wait for all favorable signs to align before entering the market. After all, it’s the game of probabilities, and being able to wait for an opportune moment that brings about a high-probability trade setup is a cornerstone of every fruitful trading strategy in 2021, and years to come.

- Remember that price action always comes first, but if your strategy relies on indicators, make sure to give preference to the leading ones like Ichimoku Cloud.

- Take the emotional factor out of the equation. Once again, have patience and let the strategy prove its worth, without discarding it after a few bad calls.

- Don’t hesitate to close losing trades. If you let the losers run, even a time-proven trading strategy would fail eventually.

Share: Tweet this or Share on Facebook

A guide to forex trading strategies

Plans are essential to keep a trader disciplined and focused. Here we will cover the various trading styles that can be used to trade forex. Following this, we will dive deeper into specific examples of forex trading strategies commonly used by traders.

A forex trading strategy helps to provide traders with insight into when or where to buy or sell a currency pair. However, no forex trading strategy is ‘best’ and not all forex trading strategies were created equal, and some may work better in certain situations. Continue reading to see how to get started with our forex trading system using various methods of analysis, including technical and fundamental. We also provide examples of a forex trading plan.

See inside our platform

Get tight spreads, no hidden fees and access to 10,000+ instruments.

Includes free demo account

Quick link to content:

How to develop a forex trading strategy

- Be aware of what type of trader you are and what types of strategies exist. However, it is not as simple as selecting a single trading strategy, as traders can choose to employ a single strategy or combine several.

- Define your criteria for selecting a forex trading strategy. You should analyse factors that can help narrow down your search. What is FX and how does it work?

- Decide whether you want to go long or short. This depends on whether you think the currency pair’s value will rise or fall over time — see our example guide on how to short pound sterling.

- Choose your currency pair. Your strategy may change based on if you choose a major, minor, or exotic currency pair, as some are more stable or volatile than others.

- Calculate the size of your position. Place your trade and make sure you monitor positions carefully for trends, breakouts, and anything else that may encourage you to switch strategies.

5 forex trading strategies

The following forex trading strategies are utilised by traders to provide structure to their trading efforts. These strategies are not specifically designed for forex markets but are rather general strategies that can be applied to all financial markets. The strategy you decide on will correlate to the type of trader you are. Open an account to start practising your forex trading strategies via spread bets and CFDs.

Forex scalping strategy

Forex traders who prefer short-term trades held for just minutes, or those who try to capture multiple price movements, would prefer scalping. Forex scalping focuses on accumulating these small but frequent profits as well as trying to limit any losses. These short-term trades would involve price movements of just a few pips, but combined with high leverage, a trader can still run the risk of significant losses.

This forex strategy is typically suited to those that can dedicate their time to the higher-volume trading periods, and can maintain focus on these rapid trades. High volume trading periods include:

- 8.00 am to 12.00 pm GMT when both New York and London exchanges are open

- 7.00 pm to 2.00 am GMT when both Tokyo and Sydney exchanges are open

- 3.00 am to 4.00 am GMT when both Tokyo and London exchanges are open

The most liquid FX currency pairs are often preferred as they contain the tightest spreads, allowing traders to enter and exit positions quickly. Some examples include:

- AUD/USD – 0.7pts minimum spread

- EUR/USD – 0.7pts minimum spread

- USD/JPY – 0.7pts minumum spread

Forex day trading

If you want to trade for short periods, but aren’t comfortable with the fast-paced nature of scalping, day trading is an alternative forex trading strategy. This typically involves one trade per day, which isn’t carried overnight. Profit or losses are a result of any intraday price changes in the relevant currency pair.

This type of trading would require sufficient time to research and monitor the trade, as well as a good understanding of how the economy could affect the pair you’re trading. If major economic news were to hit that day, it could affect your position. Find out more about forex day trading.

Forex swing trading

For traders who prefer a mid-term trading style where positions can be held for several days, there is swing trading, which aims to make a profit out of changes in price, by identifying the ‘swing highs’ or ‘swing lows’ in a trend.

Although this strategy normally means less time fixating on the market than when day trading, it does leave you at risk of any disruption overnight, or gapping. Learn more about swing trading strategies.

Forex position trading

The most patient traders may choose the forex position trading, which is less concerned with short-term market fluctuations and instead focuses on the long term. Position traders will hold forex positions for several weeks, months, or even years. The aim of this strategy is that the currency pair’s value would appreciate over a long-term period.

Forex position trading is more suited for those who cannot dedicate hours each day to trading but have an acute understanding of market fundamentals.

Carry trade in forex

A carry trade involves borrowing from a lower interest currency pair to fund the purchase of a currency pair with a higher interest rate This strategy can be either negative or positive, depending on the pair that you are trading. The aim is to profit from the difference in interest rates or the “interest rate differential” between the two foreign currencies.

Explore 330+ currency pairs

Advanced forex trading strategies

The above forex trading strategies cover general variables such as the time span a position is active, the time dedicated to researching markets and the time spent monitoring positions. This helps to distinguish when you will trade, how many positions you will open and how you will split your time between researching markets and monitoring active positions. However, the following list includes trading strategies based on important support and resistance levels that are specifically designed for the forex market.

1. Bounce strategy

Many forex traders believe levels that were important in the past could be important in the future. This follows the logic that if a market dropped to a specific level and then ‘bounced’ back, the market viewed this support level as a good place to buy. So, if the forex pair slips back to that level again it could, therefore, signify a potential trading opportunity.

2. Running out of steam strategy

Similar to analysing support levels, forex traders also analyse resistance levels. The resistance level is a point where the market turned from its previous peak and headed back down. If a market is appreciating but then suddenly falls, the overall view is likely to be that the price is getting too expensive. This forex trading strategy mirrors the bounce strategy. We are looking for the forex pair to ‘run out of steam’ near that previous high and then go short and sell to try and profit from a slide in price.

Such strategies, based on previous highs and lows on a chart, can make risk management relatively straightforward for any trader. For instance, if we are looking for a bounce off a level, our stop loss can go below that previous low point. If we are looking to sell short when a market starts to falter near a previous high, then many traders will place a stop loss above that previous high.

The forex strategy example below shows how a high from the previous day in the AUD/USD currency pair ended up being the place where the market twice ran out of steam the following morning.

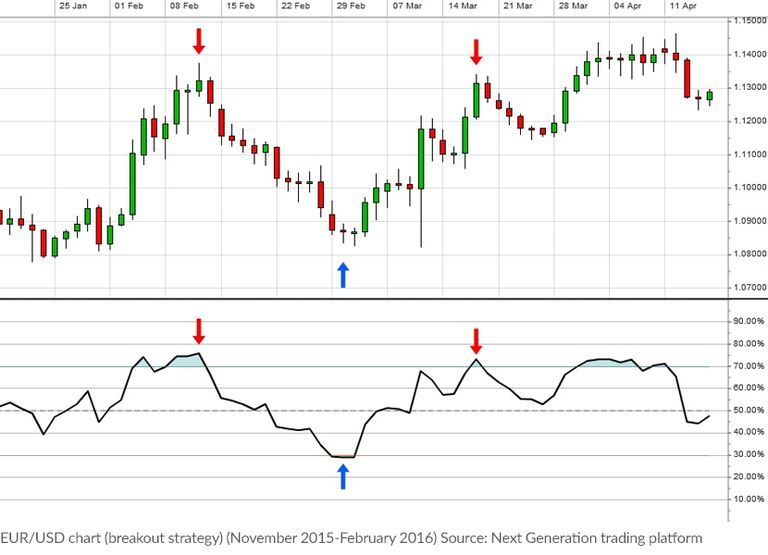

3. Breakout strategy

Resistance and support levels are dynamic and are prone to price breakouts in either direction. If the price exceeds important support or resistant levels it is likely to breakout. Many traders could view this as a potentially important change in market sentiment.

Previously when the forex pair was up at that high, the sellers moved in and the price fell, suggesting the market had reached an overvalued level. If that old high is breached, also known as breaking resistance, then something has clearly changed. Traders are now happy to keep on buying where previously they thought the price was too expensive.

This can be an effective forex trading strategy for catching new trends. Every journey starts with a single step. When direction in the markets changes then the breakout trading strategy is often one of the early signals. The example shown is for EUR/USD – a longer-term breakout on the daily charts.

4. Breakdown strategy

Similar in function, but in the opposite direction to the breakout strategy is the breakdown strategy. This forex trading strategy is designed to jump aboard a move when a forex market slips below a previous support level. Once again, many traders could view this as a change in sentiment towards the market. Suddenly a level where buyers were happy to buy as they viewed the market as cheap and expected it to rise – has been broken. This breakthrough of what is known as a support level can be viewed as an opportunity to short sell and try to profit from further weakness in price.

The example shows USD/JPY on an hourly chart. It is an important example as it demonstrates that, in the real world, even the best forex trading strategies do not work all the time. There is a false signal (highlighted by the circle) before the effective signal (highlighted by the black arrows) that saw the market really start to fall.

5. Overbought and oversold

The forex trading strategies mentioned so far have been based on chart patterns and the use of support and resistance levels. Our last strategy takes a more mathematical approach, using something called the Relative Strength Index (RSI). This belongs to a family of trading tools known as oscillators – so-called because they oscillate as the markets move. When the RSI is above 70%, the market is thought to be overbought. This means that it could be getting overstretched and some traders will use this as a signal to expect the market to fall back.

Oversold is when the RSI goes below 30%. Traders will be watching closely, expecting any weakness to run out of steam and the market to turn back up and use this as a buy signal. The FX example in this chart highlights some of the buy and sell signals that came from the overbought/oversold strategy on a daily EUR/USD chart.

Practise your trading strategies

Seamlessly open and close trades, track your progress and set up alerts

What are some strategy modifiers?

When using any of the above forex trading strategies, it is wise to be aware of methods that you can use to adapt your forex strategy. For example, depending on your strategy, you may wish to use the below strategies alongside other forex strategies to reduce risk exposure or to provide additional information for a forex trade.

Hedging forex

To protect oneself against an undesirable move in a currency pair, traders can hold both a long and short position simultaneously. This offsets your exposure to the potential downside but also limits any profit. By playing both sides of the market, you can get an idea of the direction the trend is heading, so you can potentially close your position and re-enter at a better price.

Effectively, you’re buying yourself some time in order to see where the market is going, giving yourself the opportunity to improve your position. This is particularly useful is you suspect the market to experience some short-term volatility. Therefore, hedging forex is useful for longer-term traders who predict a forex currency pair will act unfavourably but then reverse shortly after. Hedging as part of your forex strategy can help reduce some short-term losses if you predict correctly.

Price action forex trading strategy

To trade forex without examining external factors like economic news or derivative indicators, you can use a forex trading strategy based on price action. This involves reading candlestick charts and using them to identify potential trading opportunities, based solely on price movements. Generally, this strategy should be used alongside another forex trading strategy like swing trading or day trading. This way, price action can be combined with a broader strategy to help mould a trader’s next moves.

Using the price action strategy when trading forex means you can see real-time results, rather than having to wait for external factors or news to break. However, a crucial consideration for those who might use the price action strategy is that it’s very subjective, so while one trader might see an uptrend, another might predict a potential turnaround for that particular forex pair, or that time period.

Trade on forex indices

EXCLUSIVE TO CMC

Expecting major economic announcements? Our forex indices are a collection of related, strategically-selected pairs, grouped into a single basket. Trade on our 12 baskets of FX pairs, including the CMC USD Index and CMC GBP Index.

How to make a forex trading plan

- See how much time you can set aside. Whether it’s a full-time job or part-time hobby, you must decide how much of your day you can commit to forex trading.

- Set some trading goals. These ideally are measurable and have a specific timeframe attached.

- Evaluate the different strategies. Whether you’re a day trader, swing trader, or position trader, read in-depth about each different strategy to see which suits you best.

- Assess your level of risk. You should think realistically about how much capital you’re willing and able to risk, as the forex market can be volatile.

- Fill out a trading diary or journal. This is good for measuring performance over time, and you can see where exactly you made profits or went wrong in each trade in order to learn for the future.

Example of a forex trading plan

Using the above steps, we’ve come up with a simple forex trading plan example below for you to see how it could potentially work.

1 — I choose to trade the GBP/USD between 8:00 and 10:00 GMT each day before starting work.

2 — My goal is for the value of my portfolio to increase by 5% in the next 6 months.

3 — I am employing a day trading strategy as the GBP/USD currency pair is very liquid and can be volatile.

4 — I can only afford to risk a maximum of 3% of my portfolio.

5 — I review my journal notes every month to see how my trading performance and behaviour has changed and how to learn from it.

Summary

Forex trading strategies provide a basis for trading forex markets. By following a general strategy, you can help to define what type of trader you are. By defining factors such as when you like to trade and what indicators you like to trade on, you can start to develop a forex strategy. Once you have developed a strategy you can identify patterns in the markets, and test your strategies effectiveness. However, it is worth noting that there is no ‘best forex strategy’ and traders often merge strategies, or make use of strategy modifiers. This way, the forex trader is adaptable to many situations and can adapt their trading strategy to almost any forex market.

See the 7 trading strategies every trader should know to broaden your knowledge on trading styles. Explore the forex market through our award-winning Next Generation trading platform*, where you can spread bet or trade CFDs on over 330 currency pairs.

FAQS

What are forex trading strategies?

Forex trading strategies involve analysis of the market to determine the best entry and exit points, as well as position size and trade timing. Additionally, it can involve technical indicators, which a trader will use to try and forecast future market performance. A professional trader’s strategy often includes elements from different types of analysis and a wide variety of trading methods, depending on their goals and objectives. See our simple day trading strategies for ways to trade markets if you’re new to trading.

What types of analysis are used to analyse forex markets?

Forex traders can use a wide range of tools as part of their strategy to predict forex market movements, but these tools fall into the categories of technical analysis and fundamental analysis. Technical analysis involves evaluating assets based on previous market data, in an attempt to forecast market trends and reversals. This usually comes in the format of chart patterns, technical indicators or technical studies. Fundamental analysis involves the analysis of macro trends such as country relationships and company earnings announcements. There are many complex factors in fundamental analysis, but a market’s basic fundamentals should be understood before trading in that market. See more on the difference between technical and fundamental analysis.

What are the most common styles of forex trading strategies?

Forex trading strategies include a number of techniques such as time frame, forex signals used and entry/exit methods. Some of the most common trading strategies include forex scalping, day trading, swing trading and position trading.

Which forex pairs are the most volatile?

Exotic (or emerging) currency pairs are generally the most volatile currency pairs when trading. This is because there is less trading volume in these markets, which causes a lower level of liquidity. Volatile currency pairs offer the opportunity for quick profits, but trading these markets also comes with the risk of quick losses. Learn more information about major, minor and exotic forex currency pairs.

*No.1 Web-Based Platform, Platform Technology and Professional Trading, ForexBrokers.com Awards 2021; Rated Highest for Trading Ideas & Strategies, Seminars & Webinars, Trade Signals Package and Ease of Account Application/Opening, based on highest user satisfaction among spread betters, CFD and FX traders, Investment Trends 2020 UK Leverage Trading Report; Best Overall Satisfaction, Best Platform Features, Best Mobile/Tablet App, rated highest for Charting, Investment Trends 2019 UK Leverage Trading Report; Best In-House Analysts, Professional Trader Awards 2019.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

See why serious traders choose CMC

Источник https://www.forex-ratings.com/forex-strategies/?id=31539

Источник https://www.cmcmarkets.com/en-gb/learn-forex/forex-trading-strategies